Liteblue Human resources website is the USPS postal services official channel to contact the HR department. Liteblue USPS Gov online human resources department helps USPS employees to manage all their leaves, FEHB benefits and other useful features. It manages all activities undertaken by the employees, which include benefits, payment, and retirement services. You can login to your Liteblue account to USPS HR Department for leaves or any other queries.

Liteblue USPS Human resource is an essential part of the company as it is known to handle the most delicate information about the USPS employees and their day-to-day activities. Liteblue Human resources online Department also handles employees after retirement. Employees can access the information for at least 5 years.

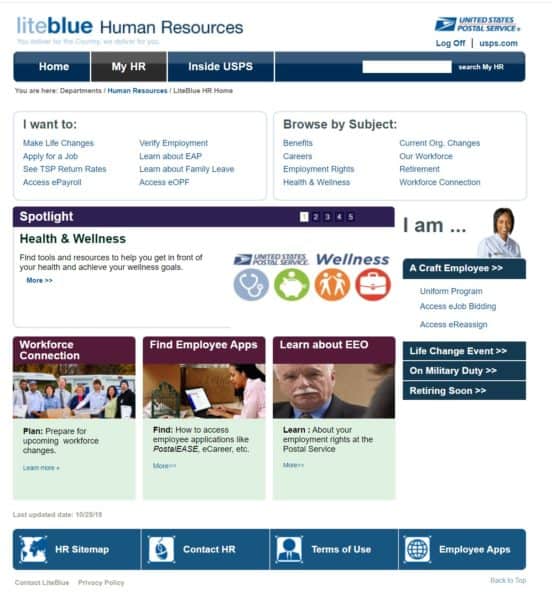

Human resource ensures that the USPS is well-integrated worldwide and offers its users the best services. In the Liteblue USPS online login portal, the webpage provides the employee with a tab ‘MY HR’ in which the user accesses the department. The hr department will list the services they offer; therefore, the user will click on which of them they want to access.

The employees and users can access information from the Liteblue HR platform, such as employee rights, health and medical preferences, Benefits, careers, and workforce. The human resource department also organizes employees’ life investments and payslips. It also ensures that the employee is satisfied with the services and treated with care and respect.

Topics Covered Inside

Access Liteblue USPS Gov Human Resource

- You are provided with a Liteblue USPS HR link when you visit the Liteblue Login portal.

- Click on the link to open the USPS Gov Human Resource webpage.

In the Liteblue USPS platform, you will be provided with all the USPS services; you will also see the ‘MY HR’ tab in which you will click to login and access the features and services offered by human resources USPS department.

Characteristics of Liteblue USPS gov human resource

- Employees’ workforce

It is used to ensure that employees receive the best services. It is based on the hr department. The employee workforce deals with equal opportunities and employee diversity within the company. It also ensures good relations between the employees. The employee workforce includes employee licenses and employee uniform guidelines. The employee uniform program is most important as it ensures all employees are comfortable in their workplaces.

- Employees rights

In the USPS, human resource employees are provided with a section that contains their rights. All employees are encouraged to know their rights to avoid any misunderstandings at the workplace. Regulations and rights offered include workplace rights such as no harassment of other employees.

The harassment right ensures that no employee is harassed, but all are treated with respect. In case of any mistreatment, employees are allowed to report it.

In the employees’ rights, we also contain the EEO law, which is the equal employment opportunity policy. Regardless of gender, age, and tribe, all employees have equal rights to employment and salaries in different workplaces.

- Employees’ benefits

The Liteblue USPS is known to offer different benefits to the employees; therefore, I encourage persons to join the company. There are many benefits provided by Liteblue USPS as follows; tax deduction, offer insurance to the employees. They ensure employees get paid for their overtime; employees can get sick days, absences, and leaves; they can also access their salary structures. Liteblue USPS offers money management benefits to their employees by taking care of their investments.

These are some of the many benefits offered by Liteblue USPS. As an employee of USPS, you can know various other benefits.

- Employees’ retirement.

The USPS Retirement is a webpage in the USPS employees’ platform which deals with employees’ retirement. All employees at some point in their careers, will experience withdrawal. Therefore, it is good for them to use USPS to plan theirs after retirement. Most of the time, the employees will stress out when they receive their pension later without any plan using USPS. One will be able to have their investments when that time comes. USPS offers five years after retirement services; this will help the retired with a good the plan. It also gives employees access to the FERS & CSRS publications.

- Careers

USPS allows employees to visit their career platforms where they can apply for new job opportunities. USPS will help the employee with a higher chance of getting the job compared to the outsiders. The employee can also decide to apply on a higher rank in their company USPS will help the employee get the opportunity to get the position and gain more skills.

With USPS and employees can easily navigate to a different company with better pay and a better position, .it ensures that the employee has the growth of skills in their particular departments of work.

- Employees’ safety and health

USPS ensures to carry health check-ups to their employees now and then to ensure their wellness. This also avoids employees from having many absences and sick leaves.

USPS also ensures that all employees are prevented from hazards and offered health benefits. In case of any accidents in workplaces, USPS provides that employees’ families are taken care of, and their children provided education.

The United States Postal Service is a big company that has thousands of employees. Therefore, with a vast number of workers, management is vital. One of the critical departments in USPS is the Human Resources department.

For all USPS employees, you can receive HR benefits such as paid leave, life insurance, health benefits, retirement, and many more.

So, in this article, you will get to know more about official LiteBlue USPS Human Resources. Let’s start.

How to Contact LiteBlue Human Resources?

- All USPS Liteblue employees can get answers to their queries at any time from anywhere by visiting the Human Resources official site.

- However, if you don’t get the service you are looking for from the United States Postal services official website, you can contact a human resources specialist. To contact a specialist, visit the human resources shared service center (HRSSC).

- They work from Monday through Friday as from 7 am to 8: 30 p.m. ET.

- Call them through 1-877-477-3273 and select option 5. Also, for TDD/TTY, you can call them through 1-866-260-7507. Lastly, for PostalEASE, contact them via 1-877-477-3273 and choose option 1.

- When contacting an office specialist, make sure you have your EIN and USPS PIN.

Note: The Liteblue My HR government official website is only for authorized personal only. The portal must be used for intended purposes only. The site is restricted to people who are outside of the United States.

LiteBlue Human Resources Benefits

There are four categories under the Human Resources benefits. They include; accounts, insurance, salary/leave, Change of Address, and money management. Today you will get to know each benefit in-depth.

Accounts

Under accounts, there are three sub-categories.

- Flexible Spending Account

- Health Savings Account

- Thrift Savings Plan

Flexible Spending Account

- Before enrolling for a United States government flexible spending account, you should know that there are two main programs. They include;

Health Care FSA

- The Health Care FSA is a program that covers your health care expenditures. The program is for you as a USPS employee and your family. However, it only covers health care expenses that are not covered by your health care insurance plan.

- It is not possible to reimburse your health care insurance plans using this program.

Why You Should Enroll for HCFSA

First, with this program, you will save approximately 30% of health care expenses.

Once you have more than $500 on your carry it from your current plan to the next year’s program during re-enrollment, this ensures you don’t lose your cash.

NB: The maximum income limit to register for HCFSA is $2,700.

What Health Care Expenses Eligible Under HCFSA?

The following expenses are eligible when you enroll in this program. They consist of;

- Dental such as braces, X-rays, cleanings, and exams

- A vision like contact lenses and supplies, eyeglasses, laser eye surgery, and exams

- Chiropractor, acupuncture, physical therapy

- Pregnancy test kits, pressure monitors, bandages, and much more health care equipment’s

- More information about the eligible expense.

All employees must know about the USPS EAP program.

Does HCFSA Replace My Health Care Insurance Plan?

No. Once you enroll for HCFSA, then it will only cover health care expenditures that your insurance doesn’t cover.

Dependent Care FSA

- The Dependent Care FSA is program you can pay for your dependent’s expenses like pre-school, child/adult daycare, before/after school programs, summer day camp, and babysitting (work-related or in your/someone’s home).

- If you have a child or children under thirteen years or a family member who is physically or mentally challenged and cannot take care of themselves, then you can enroll in this program.

Is there a Specific Amount of Salary to Have a Dependent Care FSA?

Yes. According to the Internal Revenue Service (IRS), the limit for one to have DCFSA are as follows.

- If you are single or a married and you file joint returns, then your limit is $5,000.

- For married couples who file separate returns, then the limit is $2,500.

- If your salary or your partner’s salary is not more than $5,000 or $2,500

Presently, the maximum limit to have DCFSA is $5,000.

NB: Remember that your annual contribution to DCFSA cannot be more than your income. This works for both single and married employees.

When and How to Enroll for Flexible Spending Accounts

Registering for FSA depends on different situations first, if you are a new or current employee. For a new USPS employee, you need to register for FSA within the first sixty days after starting work but must before 1st October. Otherwise, you can wait for the Open Season.

If you are a current employee and want to enroll for FSA, then you can do it within thirty days after the start of the Open Season. However, you might be having challenges to register during this time. In case you don’t make it to enroll, you can do after the stipulated time, but your reasons must be in the following areas.

- If you were out of the USA and you didn’t have access to internet or mobile phone

- Personal issues like wedding, the birth of your child, illness, you were hospitalized, passing on of a close relative.

- Decision about retirement

Get to know more about enrolling in FSA. Furthermore, to register or re-enroll for this, you should go to FSAFEDS.com.

Health Savings Account

The second account you can enroll for is the Health Savings Account. You can use the money in this account to repay your medical expenses. When you don’t use, or there’s cash on your account, it rolls over to the next year.

Eligibility

Before you think about registering for HSA, then this is eligibility criteria.

- If HDHP (High Deductible Health Plan) already covers you

- No health insurance covers you.

- Not a member of Medicare

- You are not dependent on another person’s ta return

How to Enroll for HSA?

- If you have already registered for high deductibles health plan in federal employee’s health benefits, then you are automatically enrolled for a health savings account.

- Visit HSA for more information.

Thrift Savings Plan

- While working, you should prepare for your retirement. Thus, for all USPS employees, you can begin saving early for your retirement through TSP.

- Thrift Savings Plan is suitable for all USPS employees as it helps you invest and, at the same time, save for your retirement.

Who is Eligible for the Thrift Savings Plan?

- All career employees are eligible for TSP. You can register at any time because there is no open season for the thrift savings plan.

- Were you employed after 31st July 2010? Then you are automatically registered for TSP. Moreover, 3% of your earning will be taken each month towards your contribution to your TSP account.

At What Age Can You Withdraw Money from TSP?

You can stay for as long as you like. However, when you attain the age of seventy and a half, then TSP will begin sending you money according to IRS requirements. In case you are still working at that age, you are advised not to receive payments till you retire from service.

Insurance Plans

There are six insurance sub-categories. They consist of;

Federal Employees Health Benefits

- Health care is essential for you and your family. With this health benefit, you are sure that all your health expenses will be covered at any time.

- To know about different health plans, visit Guide to Health Plans.

- You will need to enter your zip code, enrollment category, pay frequency, who will be covered, age of the primary insured, and healthcare category for you or your family.

- The Open Season is the time to register or make changes. Furthermore, when you are changing your family or employment status, you can also modify your plan.

- Learn more through FEHB.

USPS Health Benefits Plan

- To enroll for the USPS health benefits plan, you should be either a mail handler assistant, postal support employee, non-career rural carrier, city carrier assistant, or non-bargaining non-career employee. Or a casual employee who meets the patient protection and affordable care act.

- You can enroll or modify this plan during the Open Season, sixty days after being hired, and sixty days after qualifying for life event.

- For additional information, go to the USPS Health Benefits Plan.

Dental/Vision Program

- You require to cover your eyes and mouth as a USPS employee because there is a dental/vision program.

- To enroll for this program, you can do it during the open season, when you qualify for life events, or you are a new employee.

- Learn more info about this program through this link.

Group Life Insurance

It is also known as Federal Employees’ Group Life Insurance is a plan that guards your family against the loss of your pay. If you are a career employee or newly hired, then you are eligible.

Long Term Care

Inability to perform specific activities like dressing or bathing due to disability, illness, or old age comes with the extra expense. But you can insure yourself for such through long-term care. The cost of long-term care depends on the area you stay in.

Affordable Care Act

- Learn more about ACA through this link.

Salary/Leave

Review Salary & Benefits Info

- There are two ways of reviewing your salary and benefits.

- One is using ePayroll or PostalEASE.

- ePayroll enables non-bargaining employees to view their pay stubs.

- For PostalEASE, you can access TSP contributions, FSA & HAS elections, annual leave exchange, eTravel Net-to-bank, W-2, Federal W-4, and direct deposit.

Leave Programs

All USPS workers have different leave benefits for you under leave programs.

They include;

- Annual leave, annual leave sharing program, and annual leave exchange program

- Sick leave

- Family and medical leave act

- Holiday leave

- Military leave

- Wounded warrior leave

Money Management

The last HR benefit is money management. You will learn about retirement, commuter program, direct deposit, and financial wellness here.

Click the following links to learn more about money management.

- Retirement

- Commuter program

- Direct deposit

- Financial wellness

Conclusion

Here is all information about LiteBlue USPS Human Resources. For any issue or question about Human Resources, please leave a comment, and you will receive instant help. Thanks for reading.